How The Seattle Times focused on subscriber retention as deliberately as on acquisition

Curtis Huber and Kati Erwert, The Seattle Times,This is a series on Better News to a) showcase innovative/experimental ideas that emerge from the Knight-Lenfest Newsroom Initiative and b) share replicable tactics that benefit the news industry as a whole. This “win” comes from Curtis Huber, senior director of circulation and audience revenue, and Kati Erwert, senior vice president of product, marketing and public service, both at The Seattle Times. The Seattle Times participated in the Major Market Table Stakes program in 2017.

Question: What communities do you serve and what can you tell us about the history of your organization?

Answer: The Seattle Times is a nearly 125-year-old independent and locally owned news media company serving the Puget Sound region. We have around 160 journalists in our newsroom. We’ve won 11 Pulitzer Prizes, including one in 2020 for national reporting on the Boeing 737 MAX crisis. We are in our fourth and fifth generation of Blethen family stewards that own and operate our company.

Q: What problem were you trying to solve, and why was solving the problem strategically important for your organization?

A: We launched our metered paywall in March of 2013. We did so with some old, janky tech systems shoehorning digital processes into purpose-built technologies optimized for print. Despite those limitations, we pushed those systems to the limits with hacks, workarounds and sometimes extra manual processes to demonstrate progress.

In early 2016, we replaced our full tech stack, and overnight it changed our digital subscription business. We had tools for e-commerce and were able to realize parts and pieces of strategy that had been limited by our technical infrastructure.

So, we accelerated our digital growth dramatically. Between 2016 and 2018, we increased our digital-only subscribers by around 50% each year.

Because of that rapid pace of growth, toward the end of 2018, we were beginning to see our overall volume of growth slow because of subscription stops. We needed to shift our focus to prioritize retention.

To be clear, we’ve never not cared about retention. Subscription stops, churn and overall retention are part of our annual goal-setting. We monitor these in excruciating detail and always have. Even by maintaining our low subscriber churn rates, we reached a point that we had considerably more monthly stops to overcome due to our rapidly growing subscriber base.

To preclude the dreaded volume plateau, we needed to address retention as deliberately as we were focused on acquisition.

Q: How is this approach related to Table Stakes (e.g. one of the 7 Table Stakes and/or an outgrowth of the Knight-Lenfest initiative, etc.)?

A: This approach is related to Table Stake No. 4 (Funnel occasional users to habitual and paying/valuable loyalists).

Our focus here is an often-missed part of that funnel in the fourth Table Stake, that once you get readers to pay, make sure that they continue to do so. Keeping the existing customers in the fold and continuing to deliver on the value that inspired their subscription in the first place is much easier than acquiring new subscribers or even reacquiring former subscribers.

That is often an afterthought, but it is so critical in driving overall success. And frankly, many of the tactics used to engage users to the point they make a buying decision are the same things that drive retention.

Q: How did you go about solving the problem?

A: Right around the time we were beginning to work in earnest on these efforts, we were asked to participate in the Facebook Journalism Project Accelerator retention program.

As part of this program we did an initial review of our dunning processes and benchmarks with our coach, Tim Griggs. (Broadly speaking, dunning is the process of communicating with customers to ensure the collection of accounts receivable.)

Candidly, we came into that session a little cocky on our operational processes associated with dunning and credit card management.

Early in the launch of our paywall, a partner of ours at another newspaper had shared the importance of credit card management. We took that to heart out of the gate and improved on it when we implemented our new tech stack.

So, when Tim started asking questions about length of grace period, credit card updaters, and how we were dealing with nonpayment stops, we were quick with answers. Unfortunately, those answers were about three years old and needed a little bit of updating.

With minor modifications suggested by Tim, we worked with our team in finance to make the configuration adjustments. These were relatively small changes and did not require product or software engineering work. And to be clear, our payment failure churn (unintentional churn) was lower than industry averages already, so the improvement was significant.

It’s worth sharing here: We are a standalone, independent newspaper. We didn’t have to navigate a centralized, corporate finance team. We’ve got a whiz in our financing group who is a great partner on our audience revenue efforts; they were able to make these changes for us.

The Seattle Times built targeted messages that users receive when they’re logged into the site to remind them to update their credit card information.

Q: What worked?

A: Retention and churn reduction often focus on tactics that offer perceived value to the subscriber. These include email onboarding journeys, slick welcome series efforts, subscriber-exclusive content and events, paid social efforts for reengagement, all of which we assume have value.

They also, in most cases, have a really high level of effort and inferred value versus material results. The dunning process, on the other hand, is not a glamorous one.

Talking about configuring your finance systems is about the least sexy topic related to the customer journey. But focusing here provided really significant results in reducing our churn with minimal effort. We are talking about three key areas we addressed: grace period, credit card management and targeted customer communication.

To be more specific on the tactics, we:

- Extended our grace period to 27 days: That gave as much time as possible for us to run credit card updaters and retries on cards, while we provided email messages to the reader to preclude the stop.

- Added retry attempts on failed credit cards: This action is particularly valuable for soft bounces, where perhaps the balance for the attempt just needs to be freed up.

- Made additional attempts of credit card updaters: This tactic is helpful in instances of card reissues.

- Sent additional email notifications to readers of credit card expiration: We had these in place and refreshed those notification emails.

- Targeted site messaging: We have a user messaging system that we built in-house to target messages to users when they are logged into the site; this approach is a powerful way to message those users with a card about to or past expiration.

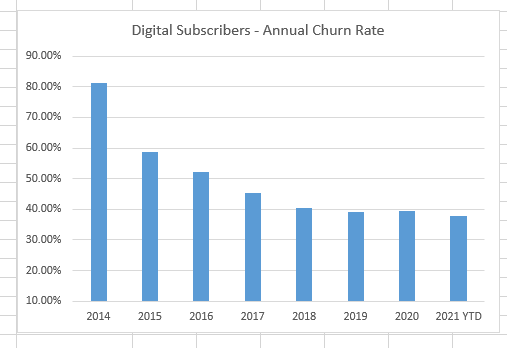

The initial result of this was a 21% decline in non-payment stops. Unintentional churn is at its lowest point in our history of digital subscriptions at 9.72% annually.

The chart shows the decreasing annual churn rate of digital subscribers to The Seattle Times. Unintentional churn is at its lowest point in the Times’ history of digital subscriptions at 9.72% annually.

Q: What didn’t work?

A: In addition to the dunning process, we did focus on subscriber exclusive events and emails. They are important engagement opportunities, but they did not necessarily materialize an impact as it relates to churn.

Q: What happened that you didn’t expect?

A: We didn’t expect results to be so strong. Our non-payment stops were the largest portion of our overall stops, but when discussing benchmarks we were already well below industry averages on non-payments.

We’d made credit card management a priority early on. Our credit card updating processes were in place and worked well. When they were originally implemented, they resulted in a 30% decrease in non-payment stops. We really didn’t think we had that much more room to decline.

Q: What would you do differently now? What did you learn?

A: We’ve really learned that there is no part of our digital subscription management that we can set-and-forget. E-commerce strategies continue to evolve and “best practices” are continually changing.

Another key lesson: Progress doesn’t have to come with a mountain of resources and a high level of effort. These were some minor system configuration changes that were handled by two people and a key vendor within our tech stack.

We were able to track the incremental decrease in stops immediately after making the changes. Unlike so many retention strategies that you implement and that take months and months to determine if they have an impact, we saw results right away in the decreased stops.

And finally, it was a great reminder of the benefits of a small and nimble team empowered to make decisions and move quickly.

Q: What advice would you give to others who try to do this?

A: We were provided great advice early on around credit card management and keeping eyes on the dunning process. For anyone focused on digital subscription growth, don’t lose sight of that aspect of your business. Prioritize credit card management over the high-resource demands of other ways of managing churn.

Q: Anything else you want to share about this initiative?

A: It is worth noting that these efforts significantly affected core and non-core churn. We do evaluate non-core (those digital subscribers fewer than one year tenured) separately as we allow online cancellation for non-core subscribers.